Sales Tax For Philadelphia Pa – While the online second-hand market has flourished, traditional thrift stores and second-hand shops continue to play an important role in the buying and selling of pre-owned goods. The adage “you get what you pay for” rings especially true in the realm of quality goods. The dynamics of a sale can vary dramatically depending on the context. Online platforms like Etsy, for example, have given artisans a global audience for their high-quality handmade goods. For the seller, the goal is often to maximize the value of the business, which requires a clear understanding of the company’s assets, liabilities, and future earning potential. In conclusion, second-hand goods for sale represent more than just a financial transaction; they embody a shift toward sustainability, individuality, and social responsibility. While buying and selling second-hand items can come with its challenges, the rewards—both financially and environmentally—make it a worthwhile pursuit for many people. Millennials and Gen Z, in particular, have embraced the idea of second-hand shopping as a way to challenge consumerism, reduce waste, and express their individuality. On the other hand, buyers may seek to negotiate lower terms based on the findings from their due diligence or their assessment of the business’s future potential. In many cases, sellers may work with business brokers, financial advisors, or accountants to help value the business and identify potential buyers. The longer something is used, the less likely it is to contribute to the growing problem of waste. There are those who argue that not everything should be for sale. Additionally, trends in sustainability and eco-conscious living have contributed to the growth of the second-hand market, as consumers become more aware of the environmental impact of their purchasing decisions. However, buying a business is not a decision to be taken lightly. The sale agreement will include details about the purchase price, payment terms, assets being transferred, and any contingencies that may apply. There is also a growing trend of upcycling and repurposing second-hand goods, where items that may no longer serve their original purpose are transformed into something new and useful. With the rising costs of new products, especially in categories like electronics, clothing, and furniture, purchasing second-hand items can offer significant savings. Sometimes, a sale can feel like the closing of one chapter and the opening of another. The idea of buying things that were once owned by someone else is no longer considered taboo or lesser; rather, it has become a lifestyle choice for those who want to make smarter, more ethical purchasing decisions. The decision to sell an heirloom piece of furniture, for example, can be emotionally complex, as it involves a shift in one’s connection to the past.

Pennsylvania Sales Tax Guide for Businesses

The philadelphia county sales tax rate is 2.0%. This places philadelphia’s sales tax on par with other. 2066 wilmot st, philadelphia, pa 19124 is a 3 bed, 1 bath, 1,120 sqft townhouse in frankford, philadelphia, pennsylvania and is currently listed for sale at $139,000 with mls. The sales tax rate in philadelphia is 6%, which is comprised of a 6%.

Pennsylvania Sales Tax 2023 2024

This means that, in general, you’ll pay a total of 6%. The total sales tax rate in philadelphia comprises the pennsylvania state tax and the sales tax for philadelphia county. The minimum combined 2025 sales tax rate for philadelphia, pennsylvania is 8.0%. This is the total of state, county, and city sales tax rates. The 8% sales tax rate in.

Pennsylvania Sales Tax Guide for Businesses

The 8% sales tax rate in philadelphia consists of 6% pennsylvania state sales tax and 2% philadelphia county sales tax. The department of revenue administers the tax laws and other revenue programs of the commonwealth of pennsylvania. There is no applicable city tax or special tax. Sales tax rates in philadelphia county are determined by a single tax jurisdiction, philadelphia..

Sales Tax in Philadelphia, Pennsylvania in 2024

2020 rates included for use while preparing your income tax. Philadelphia imposes a sales tax of 8%, which consists of a state sales tax of 6% and an additional local sales tax of 2%. Combined with the state sales tax, the highest sales tax rate in pennsylvania is 8% in the cities of philadelphia, bensalem, glenside, feasterville trevose and lansdowne.

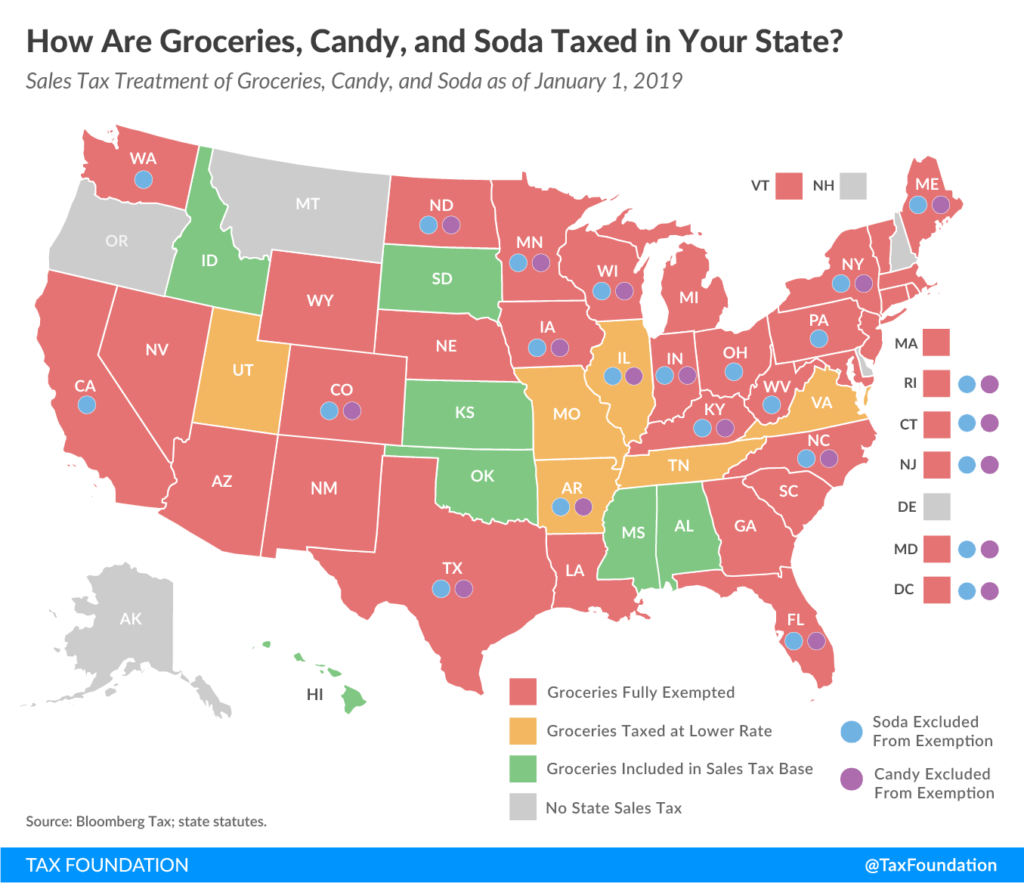

Sales Tax on Grocery Items by State Chart

The philadelphia county sales tax rate is 2.0%. The sales tax rate in philadelphia is 6%, which is comprised of a 6% state sales tax rate and a 0% local sales tax rate. This is the total of state, county, and city sales tax rates. There is no applicable city tax or special tax. No subscription feenexus monitoringfree tax consultingscheduled.

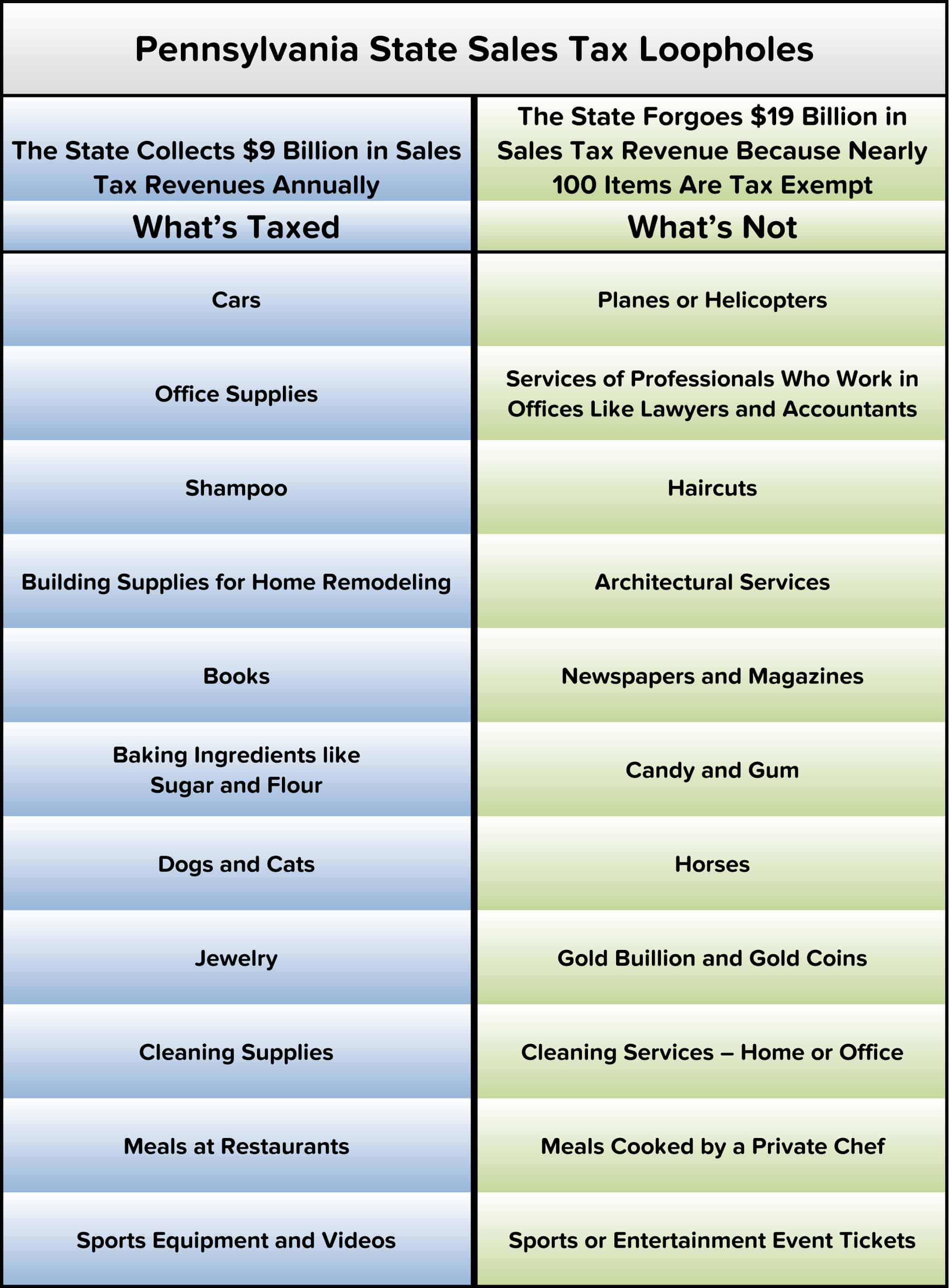

Pennsylvania State Sales Tax Loopholes Children First (Formerly

Philadelphia sales tax rate is 8.00%. The latest sales tax rate for philadelphia, pa. This places philadelphia’s sales tax on par with other. The latest sales tax rate for philadelphia county,. The sales tax rate in philadelphia is 6%, which is comprised of a 6% state sales tax rate and a 0% local sales tax rate.

Pennsylvania Sales Tax Guide

The city does not impose an. Philadelphia sales tax rate is 8.00%. The calculator will show you the total sales tax amount, as well as the. The december 2020 total local sales tax rate was also 8.000%. Philadelphia imposes a sales tax of 8%, which consists of a state sales tax of 6% and an additional local sales tax of.

Pennsylvania Tax Sales Tax Deeds YouTube

The philadelphia sales tax rate is 0%. The minimum combined 2025 sales tax rate for philadelphia, pennsylvania is 8.0%. You can use our pennsylvania sales tax calculator to look up sales tax rates in pennsylvania by address / zip code. The latest sales tax rate for philadelphia county,. Philadelphia sales tax rate is 8.00%.

Ultimate Pennsylvania Sales Tax Guide Zamp

The december 2020 total local sales tax rate was also 8.000%. The minimum combined 2025 sales tax rate for philadelphia, pennsylvania is 8.0%. The philadelphia county, pennsylvania sales tax is 8.00%, consisting of 6.00% pennsylvania state sales tax and 2.00% philadelphia county local sales taxes.the local sales tax consists of. The average cumulative sales tax rate in philadelphia, pennsylvania is.

Pennsylvania Sales Tax Guide for Businesses

The philadelphia county sales tax rate is 2.0%. The total sales tax rate in philadelphia comprises the pennsylvania state tax and the sales tax for philadelphia county. These figures are the sum of the rates together on the state, county,. The latest sales tax rate for philadelphia, pa. The current total local sales tax rate in philadelphia county, pa is.

For sellers, online platforms provide a global marketplace, allowing them to reach a wider audience than they would through traditional brick-and-mortar stores. The advent of these online platforms means that consumers can hunt for items they might have otherwise overlooked or been unaware of, sometimes at a fraction of the original cost. To mitigate this risk, buyers should ask for detailed photos, read product descriptions carefully, and inquire about the condition of the item before making a purchase. It is subjective, shaped by cultural norms, individual preferences, and the evolving standards of various industries. Entrepreneurs can launch businesses from their homes, and freelancers can offer their skills to clients across the world. For some, the thrill of hunting for unique, one-of-a-kind items is as much a part of the experience as the purchase itself. We are all participants in a vast, interconnected economy, one that doesn’t just involve physical goods but extends to ideas, relationships, and even identities. Business brokers play a key role in facilitating the transaction by acting as intermediaries between the buyer and seller. If the buyer is satisfied with the findings, the next step is usually negotiation. One of the primary reasons people turn to second-hand goods for sale is financial. They remind us that, despite living in a world where everything is for sale, there are some things that remain priceless. It’s easy to understand why people seek out quality goods for sale. The world of second-hand shopping has also made quality goods more accessible. Economic downturns, for example, can influence the types of businesses that are put up for sale, as struggling companies may look to exit the market. In the world of quality goods for sale, there is also an inherent sense of value in the stories behind them. This desire for items with character and a story behind them has contributed to the growing appeal of second-hand goods. The idea that everything has a price, and that everything is for sale, may seem like a grim outlook, but it’s one that has become increasingly true. Perhaps the most troubling aspect of the idea that everything is for sale is how it can shape the way we view the world and each other. For the seller, the goal is to achieve the highest price possible for the business, while for the buyer, the goal is often to secure a fair price that reflects the true value of the business. Many sellers of second-hand electronics offer refurbished items, which have been inspected, repaired, and restored to a like-new condition.

When you buy something made from premium materials, crafted with attention to detail, and tested for reliability, you can expect it to deliver value that surpasses its initial cost. Some goods, like a fine Swiss watch, carry decades or even centuries of tradition, built on a reputation of precision and excellence. It can be a metaphor for much deeper exchanges in life. The internet, for example, has created a space where anyone can buy or sell almost anything, from physical products to intangible services. The struggle is not in resisting the marketplace entirely, but in finding balance, in ensuring that the things that truly matter cannot be bought, sold, or traded. The growing interest in second-hand goods can also be attributed to shifting cultural attitudes toward consumption. People are not just looking for things that work well; they want products that elevate their environment and their experiences. Sometimes, a sale can feel like the closing of one chapter and the opening of another. If the buyer is satisfied with the findings, the next step is usually negotiation. Many high-quality products come with a rich history, whether it’s the legacy of a renowned brand or the personal touch of a local maker. Similarly, during periods of economic growth, there may be a greater willingness to spend on luxury second-hand items, such as high-end fashion or collectible items. Self-help books and motivational speakers promise to sell us the tools to fix ourselves, to buy into a better version of who we could be. The notion suggests a world where anything and everything, regardless of its intrinsic value, can be bought, sold, or traded. Legal experts are often involved at this stage to ensure that the transaction is conducted in compliance with all relevant laws and regulations. Thrift stores often carry a wide variety of goods, from clothing and accessories to furniture, books, and electronics, and each item comes with its own story. As more and more people become concerned about the planet’s resources and the impact of consumerism on the environment, the concept of buying used goods has gained traction as a more sustainable alternative to purchasing new products. Unlike mass-produced items that may become outdated or fall apart with minimal use, quality products are designed to endure. Vintage clothing, in particular, has gained a significant following, with people seeking out unique, one-of-a-kind pieces that cannot be found in mainstream stores. For those who are passionate about antiques, art, and memorabilia, the second-hand market offers endless possibilities for finding unique and valuable items that can be passed down through generations or added to a collection. Many factors can influence the negotiation, such as the business’s financial performance, industry trends, and the level of interest from other buyers.