Sales Tax Rate For Colorado Springs Co – The practice of buying and selling second-hand items has been around for centuries, but in recent years, it has seen a resurgence. Once an agreement is reached, the final step is the legal transfer of ownership. For fashion-conscious individuals, buying second-hand is a way to express their personal style while also supporting sustainable practices. A well-maintained, quality leather jacket may last a lifetime, whereas a low-cost alternative might only hold up for a couple of seasons. The very notion that everything can be bought and sold creates a society where inequality is not just accepted, but ingrained in the very structure of the economy. A well-made frying pan or a durable pair of boots might not have the cachet of a designer handbag, but their value lies in their functionality and reliability. Many people find that buying second-hand furniture allows them to acquire high-quality pieces that are built to last, often with a level of craftsmanship that is hard to find in mass-produced furniture. The resale of pre-owned clothing has become a booming industry in recent years, with second-hand stores and online marketplaces thriving as more consumers opt for affordable, sustainable alternatives to fast fashion. For some, selling a business is a proactive decision to move on to new ventures, while for others, the sale might be the result of external factors, such as market downturns, changing consumer preferences, or regulatory shifts. A well-made product simply performs better. When we begin to view everything through the lens of commerce, it’s easy to lose sight of the things that make life worth living — the moments that aren’t for sale, the experiences that can’t be bought. Additionally, trends in sustainability and eco-conscious living have contributed to the growth of the second-hand market, as consumers become more aware of the environmental impact of their purchasing decisions. The market for second-hand goods is also influenced by societal trends and economic conditions. Whether it’s an item, a service, or even a person, the act of being “for sale” represents a moment of transition, a shift from one stage of life to another. Sellers can list items with detailed descriptions and high-quality photos, giving potential buyers a clear understanding of what they are purchasing. Whether through their durability, aesthetic appeal, or the values they embody, these products go beyond simple transactions. From the most trivial items in a dollar store to the most precious works of art in a museum, everything can be assigned a price. Many high-quality products come with a rich history, whether it’s the legacy of a renowned brand or the personal touch of a local maker. Regardless of the reason, the sale of a business is an event that requires careful planning, transparent communication, and strategic negotiations. The idea that everything has a price, and that everything is for sale, may seem like a grim outlook, but it’s one that has become increasingly true.

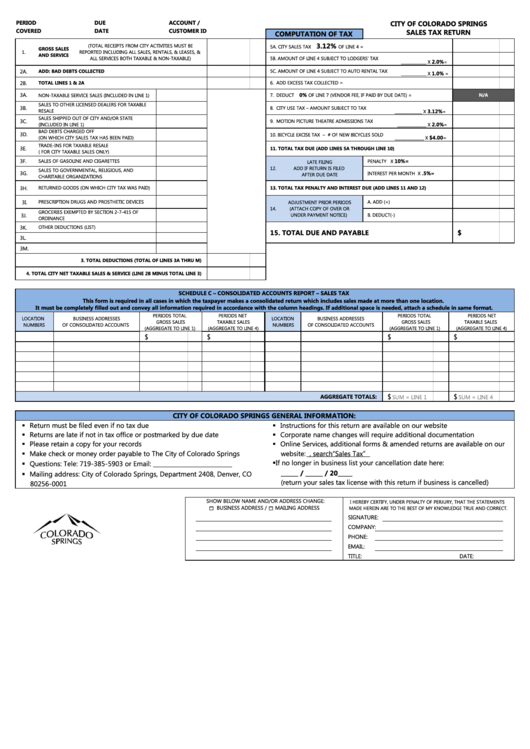

Sales Tax Return City Of Colorado Springs printable pdf download

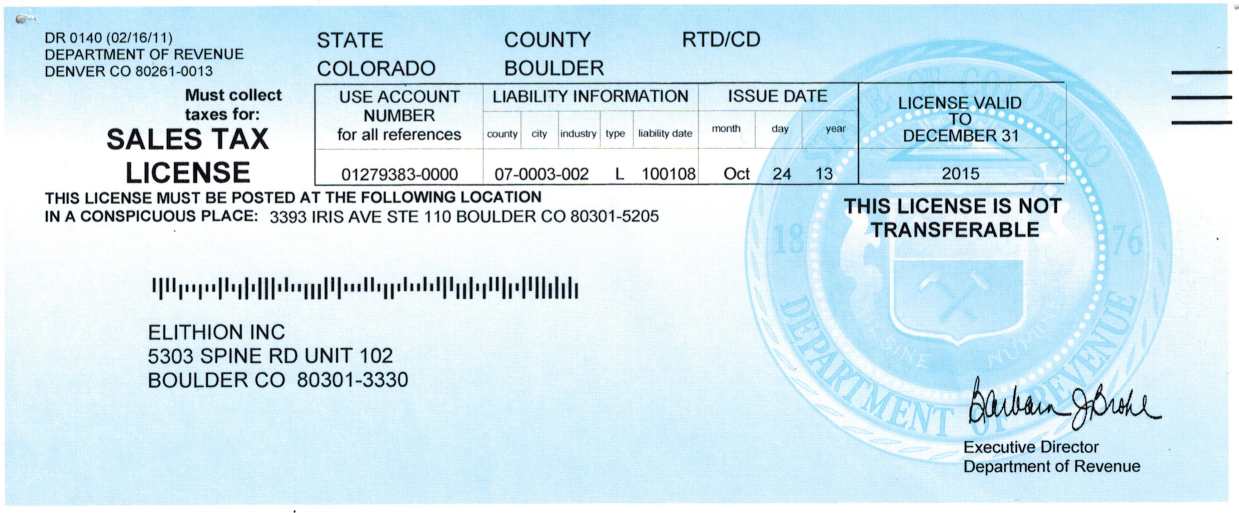

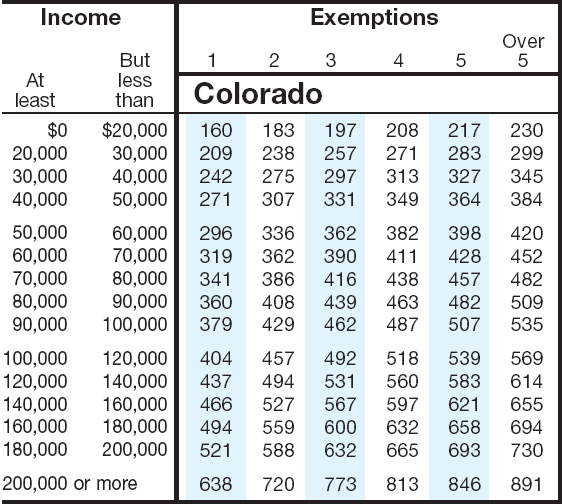

0% to 3.5%, depending on the specific zip code within the city. Effective january 1, 2021, the city of colorado springs sales and use tax rate has decreased from 3.12% to 3.07% for all transactions occurring on or after. Colorado springs sales tax rate is 8.20%. These figures are the sum of the rates together on the state,. The december.

Sales tax rate changes in Colorado TaxOps

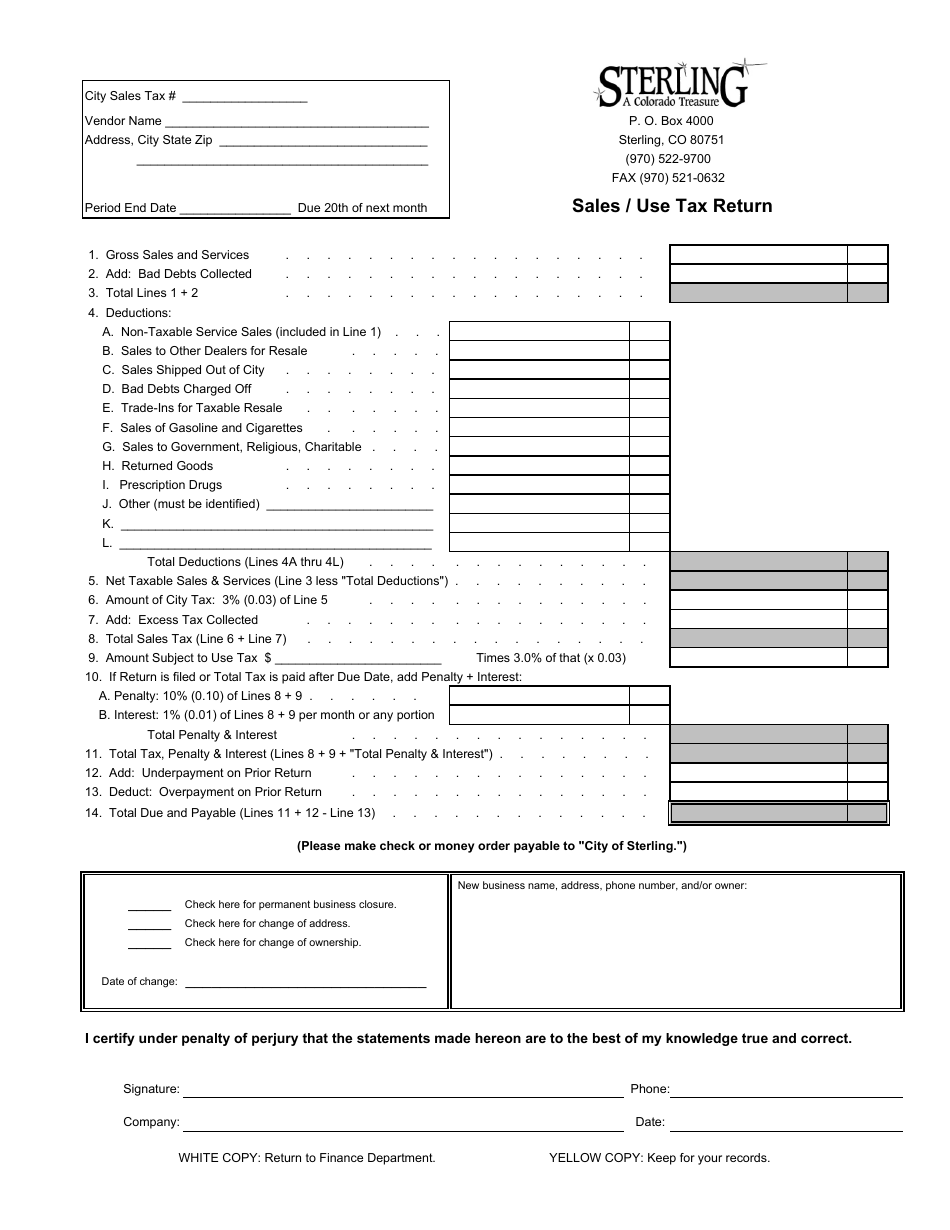

City of evans 4.5% state of colorado 2.9% total 7.4%. Colorado springs, co sales tax rate. The average cumulative sales tax rate in colorado springs, colorado is 7.8% with a range that spans from 5.13% to 8.63%. The combined rate used in this calculator (8.63%) is the result of the colorado state rate (2.9%), the 80921's county. The colorado springs.

.png)

Colorado Sales Tax Rate 2024 Kalie Cinnamon

Colorado springs sales tax rate is 8.20%. Tax rates can vary within a county, a city, or even a zip code. 0% to 3.5%, depending on the specific zip code within the city. Effective january 1, 2021 , the city of colorado springs sales and use tax rate has decreased from 3.12% to 3.07% for all transactions. While colorado law.

Tamekia Pack

The total sales tax rate in colorado springs comprises the colorado state tax, the sales tax for el paso county, and any applicable special or district. As of july 1, 2020 the total sales tax rate in the city is 7.4%. Tax rates can vary within a county, a city, or even a zip code. The colorado department of revenue.

Colorado Sales Tax Rate 2025 Lillian Wallace

This interactive sales tax map map of colorado shows how local sales tax rates vary across colorado's 64 counties. The current total local sales tax rate in colorado springs, co is 8.200%. These figures are the sum of the rates together on the state,. The current sales tax rate in 80909, co is. As of july 1, 2020 the total.

glenwood springs colorado sales tax rate Perfect Partner Blook

This rate is made up of the following components: Current city sales & use tax rate: The colorado springs sales tax rate is 3.07%. Current city sales & use tax rate: Effective january 1, 2021 , the city of colorado springs sales and use tax rate has decreased from 3.12% to 3.07% for all transactions.

Colorado Springs Sales Tax Rate 2024 Janey Lisbeth

These figures are the sum of the rates together on the state,. While colorado law allows municipalities to collect a local option sales tax of up to 4.2%,. Effective january 1, 2021, the city of colorado springs sales and use tax rate has decreased from 3.12% to 3.07% for all transactions occurring on or after. Look up the current rate.

State Sales Tax State Sales Tax For Colorado

Tax rates can vary within a county, a city, or even a zip code. Current city sales & use tax rate: Colorado springs sales tax rate is 8.20%. What is the sales tax in colorado springs? These figures are the sum of the rates together on the state,.

Colorado Springs Sales Tax Calculator

The total sales tax rate in colorado springs consists of the colorado state tax rate, the el paso county tax rate, and the city tax. This interactive sales tax map map of colorado shows how local sales tax rates vary across colorado's 64 counties. What is the sales tax in colorado springs? Colorado springs sales tax rate is 8.20%. Colorado.

Combined State And Local Sales Tax Rate Colorado Tax Walls

In colorado springs the total sales tax rate, including county and city taxes, ranges from 2.9% to 8.63% city rate: The colorado springs, colorado sales tax is 2.90% , the same as the colorado state sales tax. The total sales tax rate in colorado springs consists of the colorado state tax rate, the el paso county tax rate, and the.

For many people, there is something uniquely satisfying about sifting through racks of clothes, rummaging through bins of books, or browsing shelves of home goods in search of that perfect item. It is only through diligent research that a buyer can truly determine whether the business is worth the asking price. For environmentally conscious consumers, buying second-hand is not just a cost-effective choice, but a way to make a positive contribution to the planet. They also often help with legal and financial aspects, ensuring that the transaction is completed smoothly and efficiently. For when everything is for sale, it’s easy to forget that the most important things in life are not commodities; they are experiences, relationships, and moments of connection that cannot be measured in dollars and cents. The advent of these online platforms means that consumers can hunt for items they might have otherwise overlooked or been unaware of, sometimes at a fraction of the original cost. For the seller, the goal is often to maximize the value of the business, which requires a clear understanding of the company’s assets, liabilities, and future earning potential. Overpricing an item can lead to it sitting unsold, while underpricing it can result in lost potential revenue. Thrift stores, estate sales, and online marketplaces are excellent places to find second-hand furniture, with options ranging from antique and vintage pieces to more contemporary items. Manufacturing new items requires energy, raw materials, and natural resources, all of which contribute to environmental degradation. As more and more people become concerned about the planet’s resources and the impact of consumerism on the environment, the concept of buying used goods has gained traction as a more sustainable alternative to purchasing new products. Take, for example, a high-quality piece of furniture — a well-crafted sofa or dining table can last for decades if maintained properly. Buyers can often filter search results by price, condition, and location, making it easier to find the best deals. Even in a marketplace where everything is commodified, there is still room for those moments and experiences that transcend value. This has opened up new opportunities for small businesses to thrive and for consumers to access unique, well-made items that they might not have encountered otherwise. But what about the intangible things? Can memories be bought? Can feelings, emotions, or connections be traded? In a sense, many people would argue that in today’s world, even the intangible is up for grabs. The durability and longevity of these products mean they don’t need to be replaced as frequently, reducing the need for constant purchases and ultimately saving money in the process. The digital age has also transformed the way things are bought and sold. And, in a way, this is the ultimate form of freedom: the ability to buy, sell, and trade on your own terms. Thrift stores, consignment shops, and online marketplaces like eBay and Poshmark provide a platform for people to sell or buy pre-owned high-quality goods.

While many artists and creators are forced to sell their work in order to make a living, there is still a sense of purity in the act of creation. Acquiring an established business can provide a head start in terms of customer relationships, operational systems, and brand recognition. A well-made product simply performs better. It is also important to check the seller’s reputation and read reviews or feedback from previous buyers. It may have been passed down, carefully preserved, and lovingly maintained. On the other hand, traditional industries such as brick-and-mortar retail or manufacturing may face challenges, with many businesses in these sectors looking to sell or transition due to changing market conditions. Upcycling is a great way to make the most out of second-hand goods, adding both value and meaning to the items that are being repurposed. Perhaps the most troubling aspect of the idea that everything is for sale is how it can shape the way we view the world and each other. People can be bought and sold in the form of labor, for example, and loyalty can be traded for material gain. The decision to sell an heirloom piece of furniture, for example, can be emotionally complex, as it involves a shift in one’s connection to the past. Whether you’re the seller or the buyer, the phrase “for sale” is a reminder that everything in life is in constant motion, always moving toward something new, something different, something better. It can be a metaphor for much deeper exchanges in life. The process of selling it can be seen as a form of letting go, a recognition that the future may look different from the past, but that doesn’t diminish its importance or value. It doesn’t fall apart after a few uses, nor does it need to be replaced after a season. Overpricing an item can lead to it sitting unsold, while underpricing it can result in lost potential revenue. Whether through their durability, aesthetic appeal, or the values they embody, these products go beyond simple transactions. For fashion-conscious individuals, buying second-hand is a way to express their personal style while also supporting sustainable practices. Moreover, buying second-hand items allows consumers to access unique and vintage products that may no longer be available in stores, offering a sense of individuality that is often missing from mass-produced, new items. In a sense, the very nature of human existence can feel like a transaction. The ability to share knowledge, ideas, and resources has empowered individuals in ways that were previously unimaginable.